Overview

The Network Token Service from Fiserv offers enhanced security and reduces fraud while maintaining a seamless payment experience for you and your customers.

Network tokens act as substitutes for cardholders' sensitive primary account numbers (PANs) in card-on-file transactions. They automatically update to ensure that credentials remain current, even if there are changes to the underlying card data.

The Network Token Service from Fiserv provides a single integration point to all four major card networks (Visa®, Mastercard®, American Express®, and Discover®), you to implement network tokens without any change to the way you accept payments.

CardPointe currently supports network tokens for Visa and Mastercard accounts.

Support for Discover and Amex is coming soon.

Benefits

Merchants enrolled in the Network Token Service from Fiserv take advantage of the folliowing benefits:

- Enhanced security and fraud protection

- Higher approval rates and revenue growth

- Better payment and checkout experience

- Potential cost savings in interchange fees

Additionally, the Network Token Service provides your customers the following benefits:

- Peace of mind that card details are secure

- Reduced friction and frustration at checkout

- Automatic updates when a card is expired or replaced

Getting Started

To enroll in the Network Token Service from Fiserv, contact your account representative to get started.

How it Works

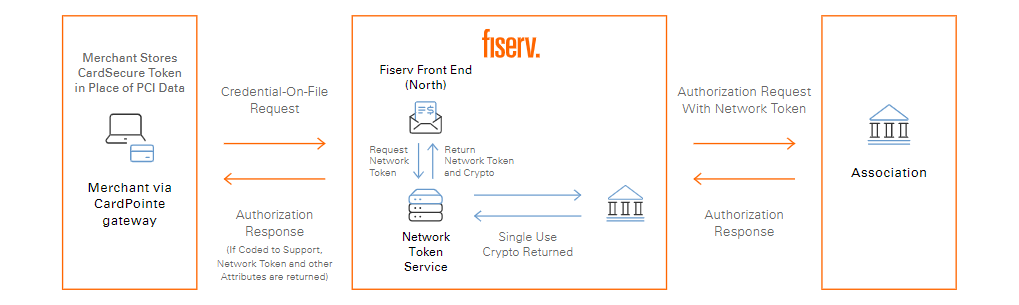

The Network Token Service generates merchant-specific account tokens for use in card-on-file (COF) payments. This increases security by authenticating the payment with single-use cryptograms and merchant-specific data, instead of using the account's PAN.

Network Tokens are automatically maintained by the card networks and dynamically updated in real time to ensure credentials are always up to date.

When you accept a payment, The CardPointe Gateway securely transmits the transaction data to the Network Token Service from Fiserv to obtain the network token prior to sending the authorization request to the card networks.

The following diagram illustrates the CardPointe transaction lifecycle using the Network Token Service from Fiserv: