What's Changing?

Previously, when a Fiserv ACH sales transaction was rejected, it resulted in the creation of an ACH return transaction line item that was included in a funding batch regardless of whether the transaction was successfully funded or not. ACH Rejects were displayed as negative entries within a funding batch and, in the case where the transaction was not successfully funded, the reporting was missing the positive entry for the transaction.

With this update, when a transaction is rejected and has not been funded, a new ACH Reject transaction record will not be created. Instead, the status of the original sales transaction will be marked as Rejected. The ACH return code linked to this transaction will be visible in the transaction table within the Transactions tab under Reporting, as well as on the Transaction Details page under Transaction History and History Data.

The offsetting ACH reject transaction will no longer be featured on the Funding tab within the Reporting section. Instead, the original transaction will be assigned a funding batch and marked as "Rejected."

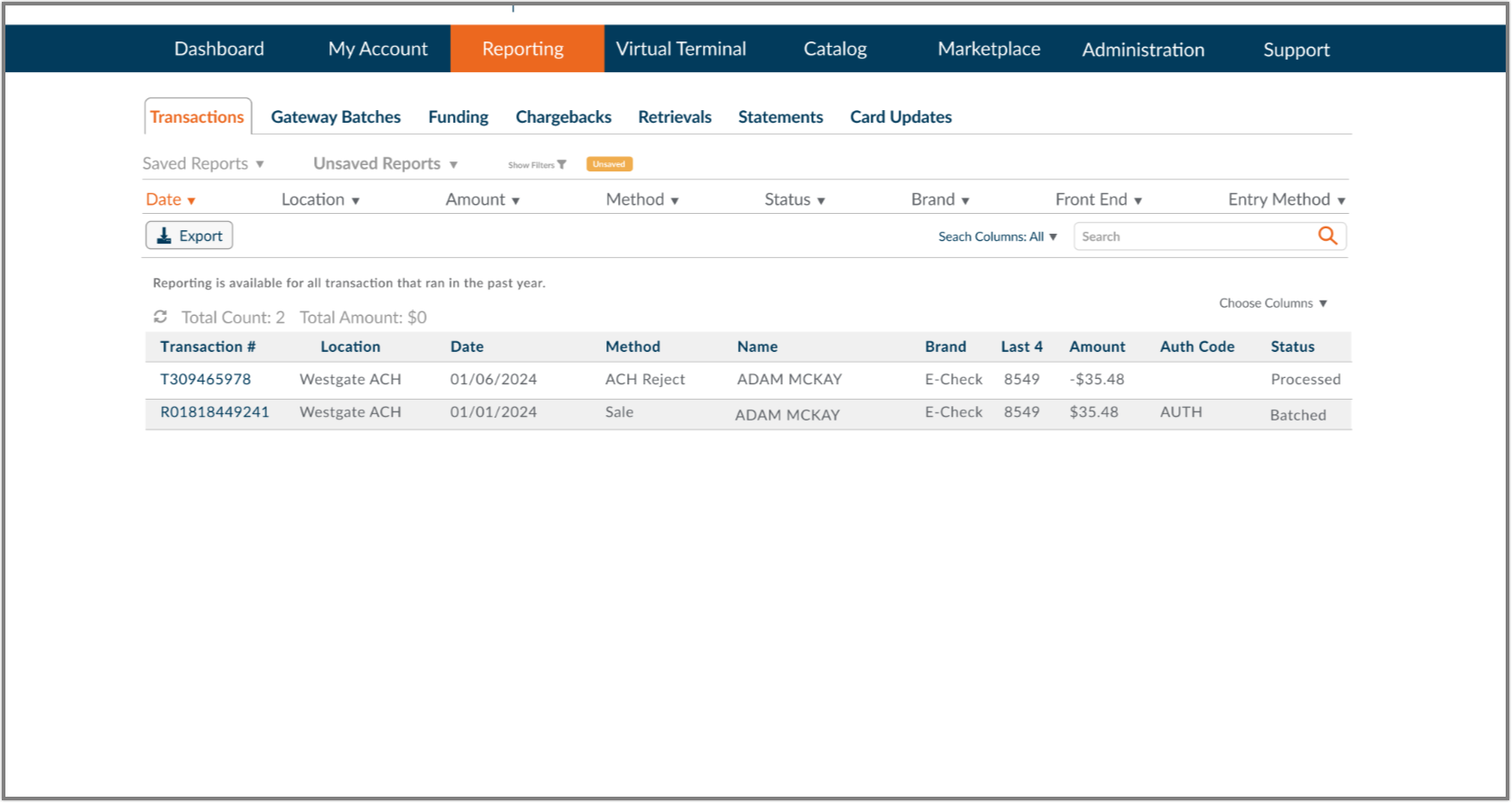

Below is an illustration of the previous reporting view, showcasing the creation of a new transaction record with a negative entry due to a rejected transaction.

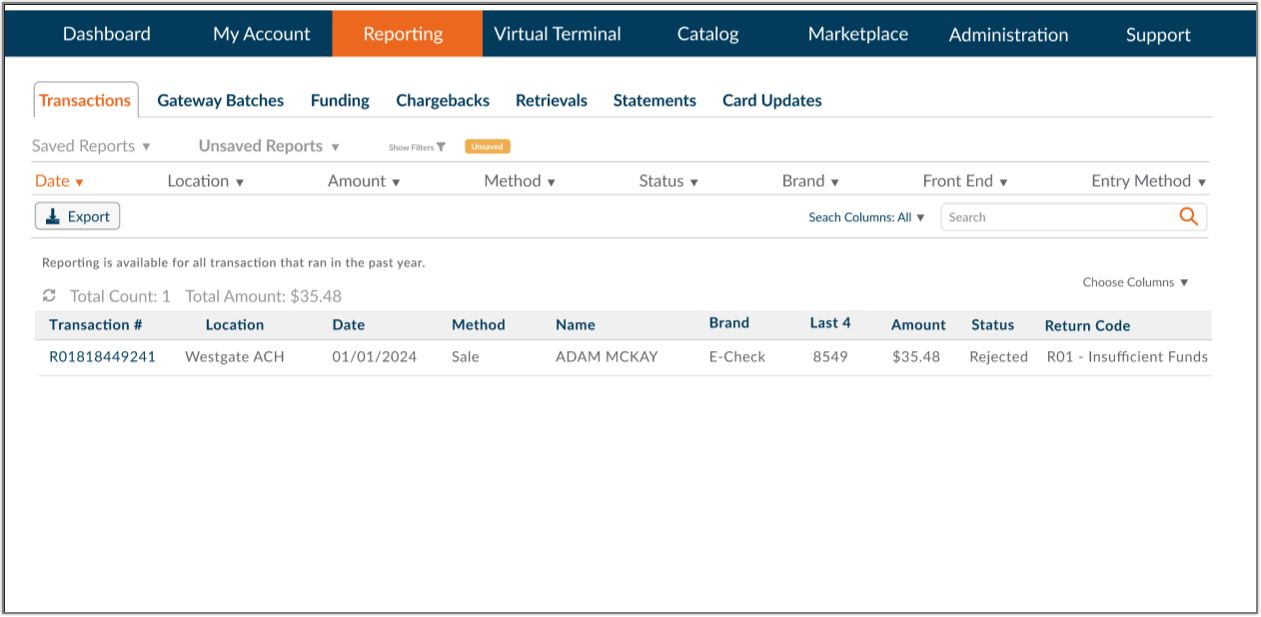

Below is a snapshot of the current reporting view. This indicates that the Status of this transaction record has been updated to Rejected, instead of generating a negative entry in the reporting.

This shift aims to enhance clarity and precision in conveying the rejection status of the transaction record within the reporting framework.

What Do I Need to Do?

As a result of the modification in ACH Reject reporting, you might need to make some adjustments in your financial records and accounting procedures. These changes in ACH Reject reporting could potentially impact how you maintain your books, which may require you to review and adapt your existing financial processes to ensure accuracy and consistency.